The December 4th Charleston SC Post and Courier included a rather lengthy story, by David Slade (Facebook), describing mismanagement of state employee pension funds over the past sixteen years. Here are key points from it.

When I retired in 1999 and moved to South Carolina the following year, South Carolina employee pension plans were considered fully funded and “on track to pay all promised benefits for decades to come.”

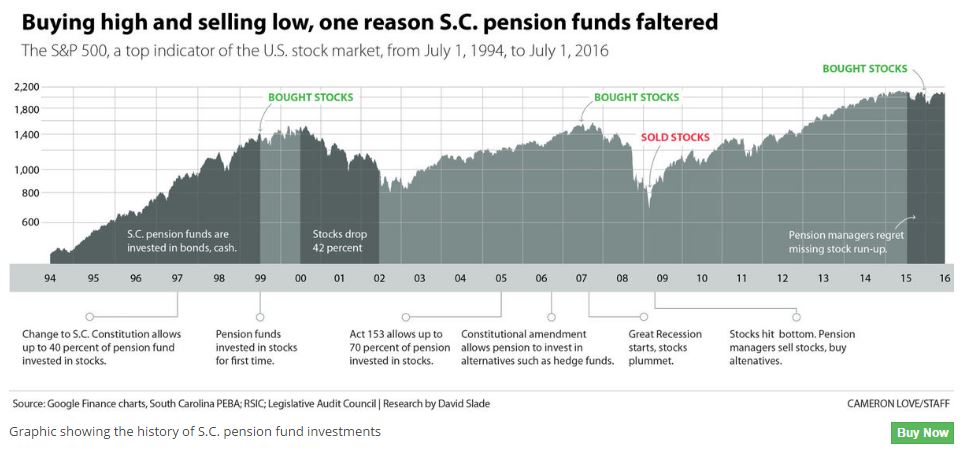

However, there was remorse over having missed the dot com stock market boom since the pension funds had been limited by law to investment in bonds and other fixed income securities. So, the state constitution was modified to allow domestic equity investments just in time to enjoy the market crash that commenced in March of 2000.

Remorse again reigned so a decision was made in 2007 to double down by jumping into overseas stocks at peak prices. And then there was the 2008-09 market crash which inspired moving money to “alternative” investments including hedge funds, restructuring firms, private real estate investments, and commodities. An expensive “Chief Investment Officer” oversaw that transition. As a result of that strategic move, much of the bull market that began in 2009 and continues today was missed.

Those bad decisions were announced as good decisions because assumptions of future returns tended to be in the neighborhood of 8% per year. Well, consistent returns of 8% per year on large amounts of money would cover lots of sins in they were actually achievable.

So now, after seventeen years of expensive mismanagement, the deficit in the pension fund is equal to two years of total income of the South Carolina state government.

And of course the simple truth is that if those responsible for the investments had just stuck with the US equities for the whole sixteen years, the fund would be in fine shape now.

As sad as that story is, South Carolina is not the worst state in terms of pension fund management. Google “state pension funds” for the terrible truth.

Of course the federal government did not make such mistakes with our national pension funds, the Social Security Trust Fund. They didn’t invest it at all. They simply spent the money and stuck in IOU’s promising to pay it back from some future tax revenues, or from borrowing, or with inflated currency. So, in spite of showing an accounting balance, the SS Trust Fund is actually empty.

Government waste on projects, personnel, and promotions is regrettable, but government frittering away the retirement security of its employees, or of its citizens, is worthy of prison terms…or at least firings.

So, yes, I am skeptical of government.

Here is an updated version of the Post and Courier article which includes much more detail than this brief post and the well-constructed but depressing chart below. We need to stay informed and pay attention.

One positive thing the chart below shows is that stocks are up about 300% since 1994. All we really had to do was get invested in some good index funds and stay invested even when a bit seasick.