In an ongoing controversy, the City of Columbia, SC, is being sued for misappropriation of water and sewer revenues. The accusation is that diversion of millions of dollars a year of sewer and water fees to such as business and tourism promotion, even as the water and sewer infrastructure crumbled and attracted the unwelcome attention of the EPA to occasional sewage overflows, was and is illegal. The plaintiffs are not seeking damages except that the funds allegedly spent inappropriately over the past several years be reimbursed and that the practice of fund transfers be stopped. I wonder who will do the reimbursing? Taxpayers, of course, since there is no other source.

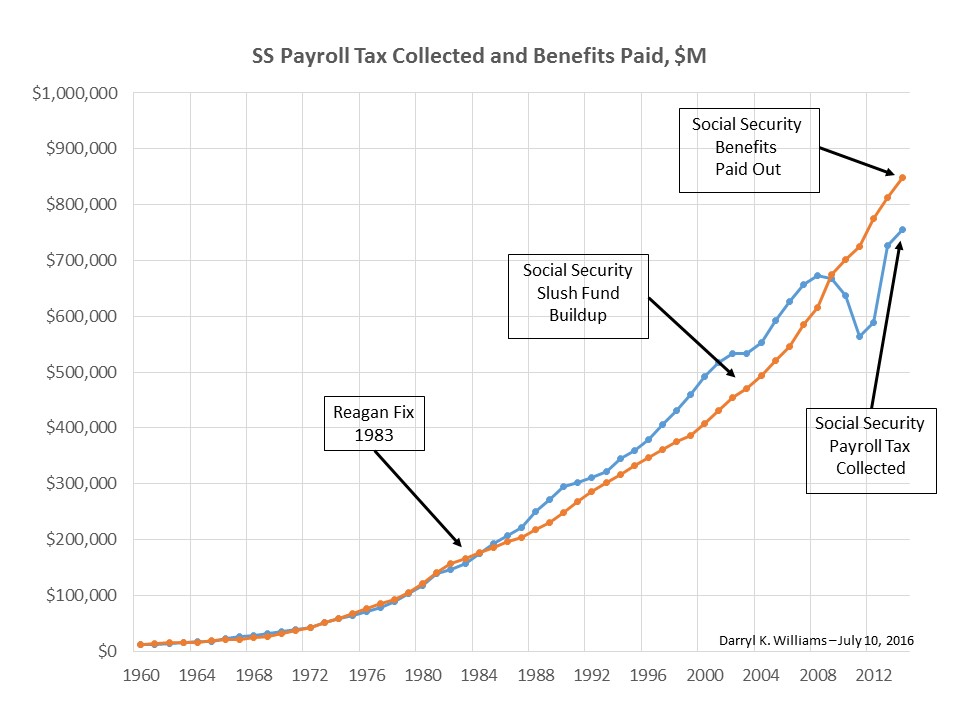

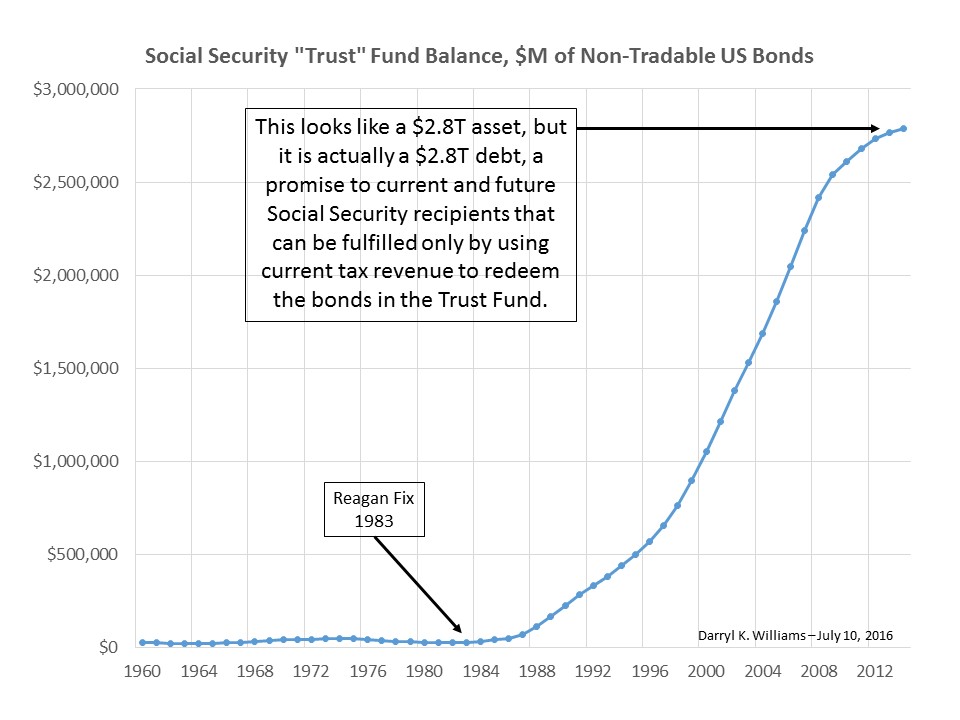

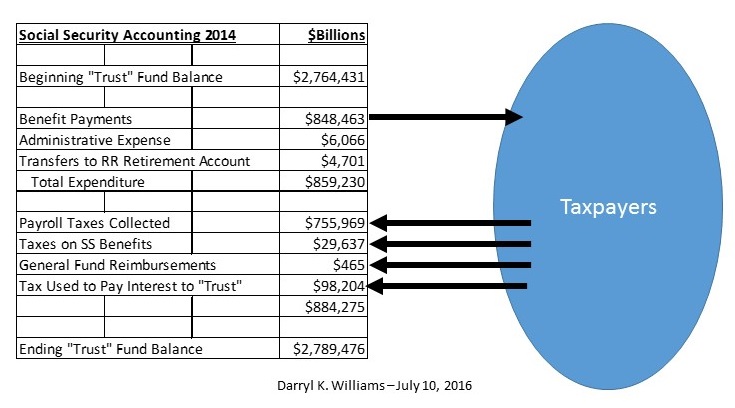

That story is not a big deal for anybody but Columbia folks, but it reminded me of a much bigger deal affecting everybody in the USA, the misappropriation, by the federal government, over the past thirty years or so (Since the “Reagan Fix) of Social Security taxes collected. The only real difference is that Columbia openly misused the funds and told us that was OK. The federal government “borrowed” the excess Social Security taxes collected, put non-tradable US bonds in the Social Security Trust Fund as markers, and misled us by claiming that the money was still there in the Trust Fund and available to pay Social Security benefits as needed. In fact, there was nothing there but more debt, simple IOU’s or promises to pay. New tax revenue would always be required to redeem the bonds and provide cash to pay out for benefits.

Someone may want to argue that I am overlooking the point that the “Trust” fund has been earning interest all those years and that I am not counting that. Of course the only way such interest could be earned would be by diverting taxpayer dollars to the “Trust” fund, so that was just another cost.

It is true that the Trust Fund represents a pretty safe debt, “backed by the full faith and credit of the United States Government,” but debt nonetheless, requiring either additional tax revenues or reduced spending in other areas to redeem the bonds as cash for benefits is needed. And, now, since 2009, Social Security Tax revenues are falling short of the benefit expenditures. There is no more excess money to “borrow,” and the shortfall has to be made up from other revenues.

In general, older folks like to argue that the Social Security system is financially sound and not in need of any reform such as reductions in benefits (though increased taxes on working folks would be OK) because they know that the big trust fund, the federal government obligation to pay benefits, is adequate for the rest of their lives. Such folks are forgetting or don’t care that the result of continuation of current practices means that their grandchildren will not enjoy the same benefits.

Wise younger folks are interested in fixes such as reduced benefits for current retirees and increased taxes on folks earning more than they earn. They want that safety net to be there when they retire, but don’t really want to pay now. Everybody seems interested in somebody else paying.

My personal preference as a fix for this problem is that benefits be phased out for all who meet some reasonable income level from other sources, the national per-capita average for example, thus shrinking the Social Security payouts over the next two or three decades. Under such an approach, Social Security would truly become a welfare program, targeted at the poor, and would no longer fund golf vacations and second homes.

However, if that austere approach is not politically palatable, my second preference would be a significant boost in Social Security Taxes to begin redeeming the place marker bonds and truly funding the Trust, all assets to be invested in some well diversified global stock and bond index funds. If we did that for fifty to a hundred years, we could probably enjoy a Social Security Tax holiday for a few decades and just pay benefits from the Trust Fund.

But whether we take the austere socialist or the liberal free market approach or some middle ground, let’s pull our heads out of the sand and pay the bills as we go. There is no rational justification for Congress treating the excess Social Security Tax revenue as a slush fund or for the City of Columbia treating excess water and sewer revenues as a slush fund.

By the way, it is worth noting that the excess Social Security taxes began being collected after the 1983 Reagan Social Security Fix. Some argue that the whole thing was a ruse by President Reagan, or more likely his advisers, to increase federal revenues under false pretenses in the face of strong resistance to higher taxes. Below are links to pro and con assessments of the Reagan fix. I am on the con side. You can see the effect and the fact that the excess has now disappeared on the charts above.

Positive View of the Reagan Rescue (Misleading I believe)

Negative View of the Reagan Rescue (My view)

And here is an easy link to the Social Security data.