There is plenty of evidence that the rich are getting richer but not as much that the poor are getting poorer. The annual Forbes Magazine listing of the 400 richest in the USA provides plenty of documentation of the former. The total wealth of the top 400, all of them billionaires, is estimated at $1.7T. The wealth of billionaires swings wildly with equity values and is much higher today than in April 2009 when the stock market bottomed out. Their wealth could plummet again soon if the bearish prognosticators turn out to be right.

In line with current interest in wealth spreading, I checked to see what would be the result if all 400 on this list completely liquidated their holdings, as if they could find buyers and do so without destroying asset values, and divided up their holdings among the 47 million currently receiving food stamps. Each of the food stamp recipients would get $36,000. And I guess the former billionaires, once paupers, could join the food stamp lines along with the laid off employees from their devastated companies. That $36,000 each would probably support the recipients for a few months, but I’m not sure what would happen after that ran out.

It always bothers me when President Obama lumps millionaires and billionaires together and blames tax “loopholes” for the federal deficit problems we face. Millionaires and billionaires have little in common from a financial viewpoint. A retired millionaire can safely spend about $35,000 a year without concern about running out of funds before dying. A retired billionaire can spend tens of millions of dollars a year without such worries. Of course billionaires are usually supporting the economy by “spending” their money on investments that create value and increase demands for employees. (I hate that phrase, “create jobs.”)

Stash $500 a month in a tax deferred account with average return of 6% and you can be a millionaire in 40 years. It might be surprising that the power of compounding would get you to the billionaire level in an additional 118 years, but few of us are likely to have that much time to build our retirement funds. And who knows what the tax rates on that income would be 158 years hence.

A major issue with the poor is that they seldom have a stake in our economy through equity ownership. Our government must bear some responsibility for that. If all the money such folks have involuntarily contributed to Social Security and Medicare over their working lives, money that was given to someone else or loaned to the federal government and spent, had been invested by the Social Security and Medicare Trust Funds into broadly based stock indices rather than into federal government debt, they too would have a share of the nation’s wealth rather than a promise to be fulfilled only by ever increasing taxes on their children and grandchildren.

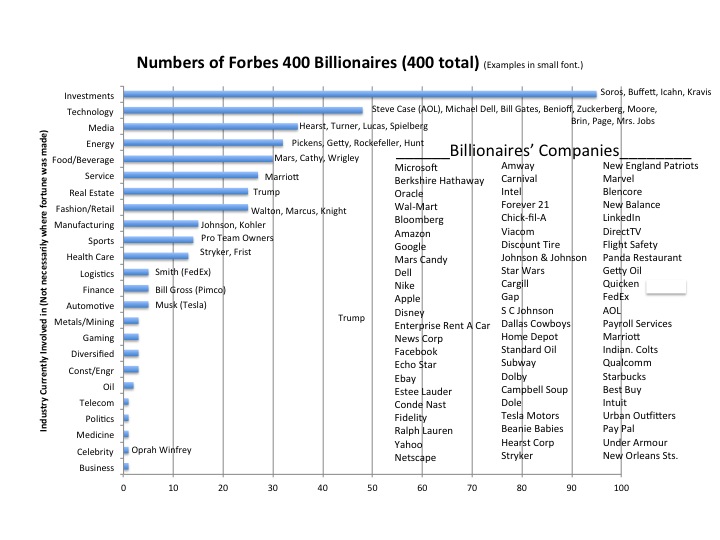

Who wants to be a billionaire? Billionaires don’t get to be billionaires by earning salaries and saving their incomes in tax deferred accounts. They get that way usually by founding and/or building companies that catch the eyes of investors and watching the values of their holdings increase dramatically as a result. There is an honor roll of such companies on the chart below. Any of us who own mutual funds in our retirement IRA’s or 401k’s probably own shares in many of these companies and benefit from and suffer from the ups and downs in the equity markets along with the founders who still hold shares. Some of the better known billionaire founder/owners are listed in the small fonts by each industry group.

The dean of this list is Gordon Moore, a founder of Intel and formulator of the famous Moore’s Law. I remember the first time I ever heard the name Intel. We had a little Kimball Swinger organ in the early 1980’s and it was always giving difficulty. A technician who came to work his way through the complicated network of wires and devices and solve whatever the current problem was told me that there was a little company in California that had invented a tiny computer chip that would do everything that Kimball organ would do. It would have taken an investment of only $12,000 in Intel then to be worth a million dollars today.

A less well known long term member is Fred Smith, founder of Federal Express. He presented the Federal Express concept in a poorly received paper while at Yale and then proceeded to build the company based in Memphis. It would have taken an investment of about $20,000 in 1980 to be worth a million dollars today.

And there is the infamous Wal-Mart which used technology to revolutionize the supply chain from manufacturer to consumer. Only $2000 invested there in 1980 would be a million dollars today.

It is easy for any of us to see the value created by Moore, Smith, Walton, Gates, Dell, Spielberg, Cathy, Trump, and other well-known names on the list. It is not clear to me yet what Mr. Zuckerberg’s contribution has been, but he has made the list.

Note: The chart shows the number in each of several industries though it is a bit misleading since the focus is on where the wealthy are now rather than where they made their money. In the Politics category, for example, we find Mayor Bloomberg, number 10 on the list with $25B, although he made his money in the Technology category. And Robert Kraft, owner of the New England Patriots, is listed in Sports though he made his fortune in paper and packaging.

Added August 6, 2016: Here is a link to the latest list, Bill Gates at #1 to Richard Yuengling at #400.