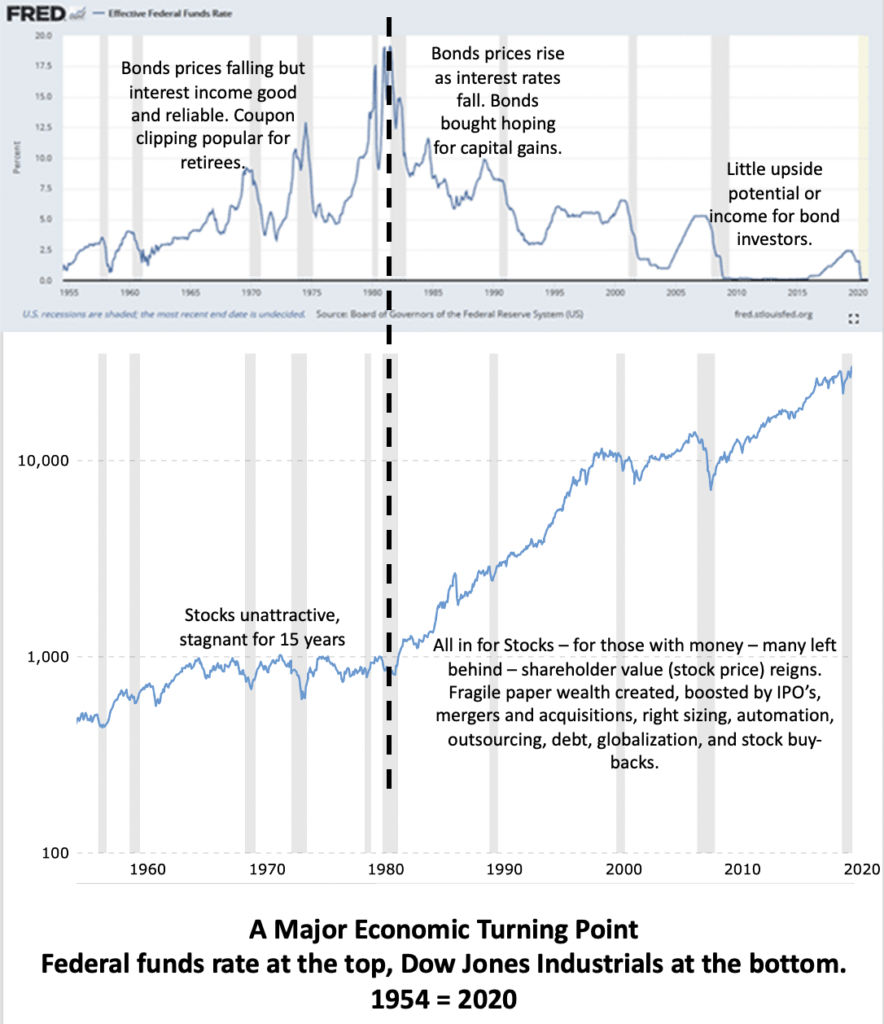

I enjoy newsletter, Thoughts from the Frontline, by John Mauldin. For December 5th, he wrote about our widening wealth gap and the discontent of “elites” who are not getting their “fair share” and of “essential workers” at the lower end of pay scales, risking their health to keep successful “elites” supplied with food and toilet paper. He attributes the problem to a major turning point in interest rates about 1980, a “Financial Neutron Bomb.” To illustrate the point, he uses this chart:

That is a dramatic turning point bound to have a major impact on the economy and its citizens. It happened forty years ago, so only about 10% of the current population lived through the sixties and seventies when bond investing was an attractive alternative to stocks and “coupon clipping” was a productive retirement activity. I lived through it and have distinct memory of frustration with the stock market, the Dow crossing 1000 for the first time in the 1960’s and then not again until 1980. That was a long time for an impatient young man.

I had the thought that attaching a plot of the DJI on the same scale would be helpful, so that is what I have done below. The Dow chart is on a log scale.

Does anybody doubt the link between interest rates and equity price trends? Does anybody really believe that the value of US stocks is thirty times what it was forty years ago? Inflation accounts for about a third of the increase.

Mauldin can explain the implications of these trends much more eloquently than I, so I will leave that to him. Check it out HERE.