We owe a lot to our billionaires! I know there is a lot of disrespect and accusations that they aren’t paying their fair share to the tax collectors. But that is due to a lack of understanding of economics and business, our system of free enterprise capitalism, of what the billionaires have created, and its value to our national economy.

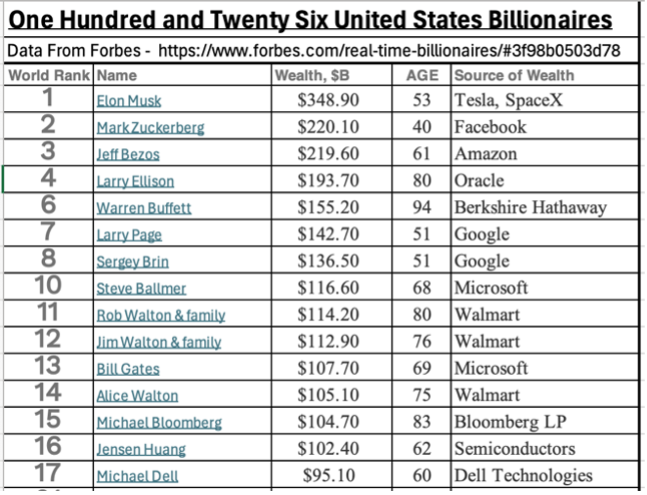

Who are these billionaires, and how many are there? Fortunately, Forbes Magazine provided all the answers to these questions recently under the title, The World’s Real Time Billionaires. Here are some simple facts derived from the Forbes list of 300 world billionaires.

- One hundred and twenty-six, 42% of the world’s billionaires, are US citizens. Since we have only about 5% of world population, that is pretty good evidence that we are the land of opportunity.

- Average age of the US billionaires is 69 and the median age is 70. They are not going to be billionaires much longer.

- Wealth of the 126 ranges from $9B to $348B. I believe there is no necessary difference in living standards from the poorest to the richest of those. One can own only so many homes, airplanes, and yachts. But the more they spend, the more they boost the national economy so we can be thankful for any un-necessary or excessive spending.

- Total wealth of the 126 is $4.3T. Total US government spending is about $7T per year so we could demand those billionaires sell everything they own and send the money to Washington DC to pay for about seven months of government spending.

- The richest fifteen of the hundred and twenty-six hold about half of the $4.3T total.

- The wealthy are taxed by the same rules as the poor, a certain percentage of income from salaries, dividends, interest, and capital gains after deductions, exclusions, exemptions, etc. The highest bracket is now 37% on income over $609,350. Some would like to see that highest bracket at 90%. That would only result in wealthy people arranging investments to generate less taxable income.

Those are the key statistics. Here are personal observations about how I view these wealthy people.

- In that richest fifteen are the founders and long-term managers and shareholders of Tesla, Space X, Starlink, Facebook, Amazon, Oracle, Berkshire Hathaway, Google, Microsoft, and Walmart. Further down the list are founders of Fidelity, Amazon, Nike, Apple, PayPal, E-Bay, Chick-Fil-A, and Airbnb. Those are huge enterprises with millions of tax-paying employees earning good incomes and making significant contributions to the wealth of our nation.

- Most of the wealth of the creators of these enterprises is not cash but is shares in the companies they founded and in other companies they have deemed worthy of financial support. They invest in America! Can anybody argue that they don’t deserve the results of their labor, intelligence, and determination that created the companies? If founding owner managers of one of these companies were to sell the stock and pay taxes on the profits, it would be seen as a lack of confidence in the company and would probably reduce the wealth of thousands of stockholders and the value of the company and its ability to expand and create jobs.

- Some propose taxing the wealthy on unrealized gains, increased values of shares still held. Considering the volatility of the stock markets, we had better be prepared to refund those taxes in the years that the unrealized gains are reduced by plummeting share prices.

- Wealth of the wealthy is generally invested in American businesses, often with global impact, providing employment for millions of tax paying citizens. Would the US Government do a better job of investing that money for the benefit of the nation? I don’t believe so. The focus of the US Government is more on transfer payments than on economic development.

- Many of the wealthy spend time and money solving problems and helping the poor much more effectively than any government agency. Microsoft founder Bill Gates is a living, leading example.

- In this great free country, we were all able to buy shares in the companies that made the billionaires and enjoy the same benefits. Many did.

- The more creative, successful, entrepreneurs we have, the less need there will be for federal government transfer payments, now about 45% of federal spending.

And here is the rearranged Forbes list of the top fifteen and the businesses they built.

I’ve been fascinated for some time with this issue. I guess I haven’t learned much because my opinions seem to be the same now as when I wrote these posts about Cornelius Vanderbilt in 2010 and Paul Allen in 2013. . Vanderbilt died in 1877, and Allen in 2018.

And these from 2013 and 2014 are on the same general subject. I guess most of my readers may be surprised at my comments about FDR.